Investors

Q1 2024 Earnings Call

Tuesday, April 30 at 5:00 ET

Investor Presentation

Learn more about how Fortune Brands is advancing its brand, innovation and channel leadership and pursuing exciting, supercharged categories.

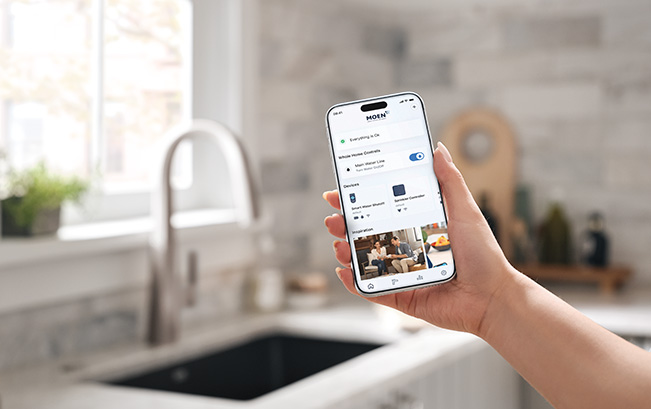

Connected Products

With our sharpened focus on brand, innovation and channel, our newly aligned structure, and recent transformative acquisitions, Fortune Brands has opportunities to advance digital and connected products throughout the home, and beyond.

CEO Discusses FBIN Transformation and More

Listen to CEO Nicholas Fink’s September 12, 2023 episode on the Inside the ICE House podcast, where he discusses the transformational activity at Fortune Brands, and so much more.

The Fortune Brands Advantage

We are fueled by the Fortune Brands Advantage, our unifying operating model across all of our businesses, which helps us continue to outperform our markets and competitors.